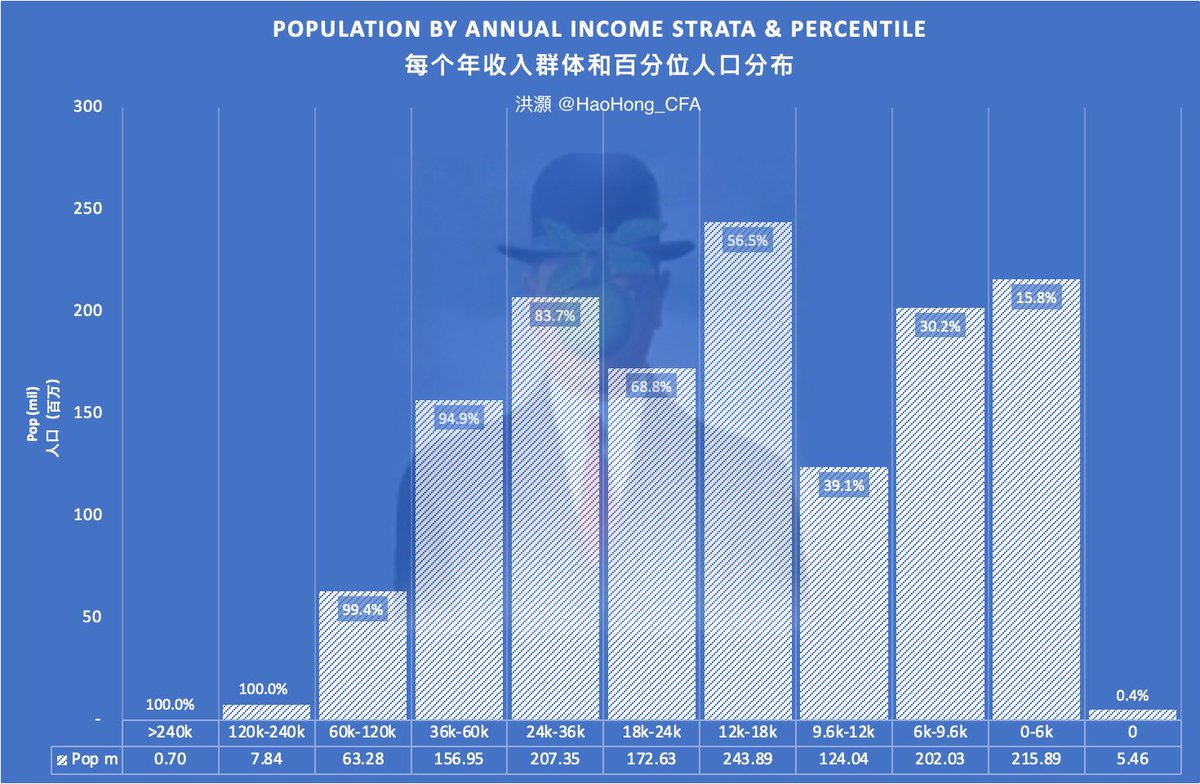

1/🧵China income data reveal new reality of “Common Prosperity”:

- Of 1,400m people, 964m <¥2k/month ($300), 547m < ¥1k ($150), only 70m people pay tax at min taxable income ¥5k/month ($770);

- ¥18k p.a. (56th %) x 2.62 pp/Household = ¥47k/HH = $7,255/HH (4th % US HH income). https://t.co/GXTGtLL2Kd

2/🧵 Only 0.7m/1.4bn population at 100th% income earning ¥240k p.a. ($37k) x 2.62pp/HH = $96.7k p.a./HH ~66% US HH income.

Consistent with CICC, NBS shows national income ¥35.1k/p.a. x 1.4bn ppl = ¥49tn, 45% of ¥110tn GDP - low globally.

3/🧵China home price ¥10k/sqm x living area 40sqm/pp x 2.62pp/HH = ¥1.05m/home. >2/3 Chinese work >25-30yrs to buy a home.

US average is ~5.4yrs. 1990 Japan property bubble was at 18yrs in Tokyo. China property value >¥400-¥500tn, 4.5xGDP.

End/🧵 To recap:

- by World Bank poverty std of $1.9/day, ~15% Chinese living in poverty; US 11.4%; but by US std >90% Chinese in poverty;

- Glaring income disparity in China: top/bottom income >40x, US 30x; ACUTE PROPERTY BUBBLE.

- Stark reality, not time yet to celebrate.

Recap: China income reality and disparity. Simply put, Chinese don’t consume simply because income share of GDP too low, and house too expensive. https://t.co/zD0mde8s1m